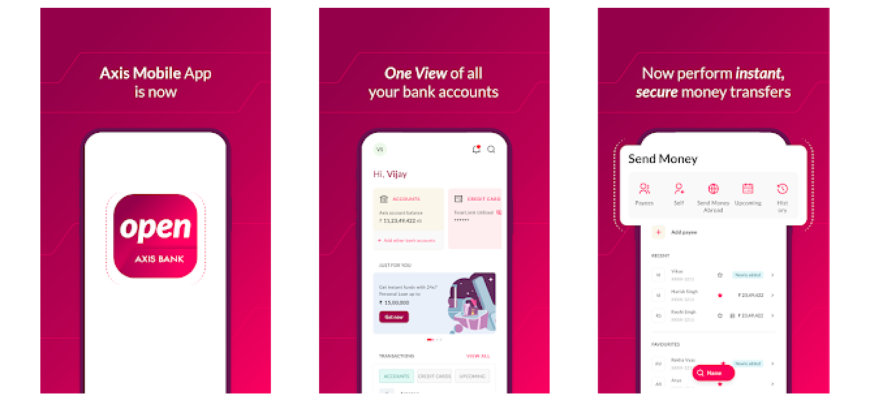

Axis Bank, one of India’s leading private sector banks, has revolutionized digital banking through the use of FlutterFlow, a low-code platform that can be used in a variety of ways, to develop its revolutionary mobile banking app. With over 50 million downloads and 13 million daily active users, the app is a success story of FlutterFlow’s ability to deliver scalable, secure, and intuitive solutions for enterprise-grade fintech solutions.

The Power of FlutterFlow in Fintech

FlutterFlow, built on top of Google’s Flutter platform, enabled Axis Bank’s development team to create a robust, cross-platform app that functions perfectly well on both iOS and Android. The platform’s drag-and-drop functionality, its pre-designed widgets, and integration capabilities reduce development time, allowing the bank to deploy features faster than with traditional coding methods—sometimes reducing UI development from weeks to hours. This rapid development cycle translated to significant cost savings, eliminating the need for large teams of highly skilled developers.

The app’s scalability stood out, capable of processing billions of dollars worth of transactions every day without any issues with performance. FlutterFlow’s integration with Firebase came without any glitch, ensuring timely updates in the database and a strong backend, and its analytics features gave Axis Bank the leverage to track user interactions and app performance, optimizing them as needed. Furthermore, FlutterFlow’s capability of integrating custom Dart code enabled the team to add functionalities specific to the bank’s requirements, improving operational effectiveness as well as customer experience.

Security and Compliance: Non-Negotiable for Fintech

Security and compliance are priorities in the strictly regulated fintech industry. It was simple for FlutterFlow to apply industry-leading security features and adhere to stringent financial regulations, such as PCI-DSS. This allowed Axis Bank to deliver a secure environment that protects sensitive user data and gains the trust of its enormous user base.

Key Benefits for Axis Bank’s Team

- Speed to Market: FlutterFlow’s visual designer enabled the team to prototype, iterate, and release features at high speed, taking up to 50% time-to-market off compared to traditional development.

- Cost Efficiency: Leverage pre-made components and avoiding coding requirements where possible, the bank kept development costs to a minimum and made the project viable even when budgets were tight.

- Scalability: Millions of transactions occur daily in the app, proving the capability of FlutterFlow to meet enterprise-level volumes.

- Enhanced User Experience: The smart UI tools provided by the platform ensured an existing and current interface that contributed towards user satisfaction and focus.

A Revolution in Enterprise Application Development

Axis Bank’s use of FlutterFlow highlights the potential for the platform to revolutionize large-scale fintech applications. With 1.5 million FlutterFlow users globally and a recent $25.5 million capital injection, the platform is well on its way to transforming business interaction with app development. For Axis Bank, FlutterFlow was not just an instrument; it was a strategic enabler that allowed the bank to deliver a world-class banking experience while remaining cost-effective and agile.

Through the intersection of rapid development, scalability, and robust security, Axis Bank’s mobile app is the benchmark for fintech success. As digital banking unrolls, FlutterFlow remains an important ally for companies looking to stay ahead in the rapid market.